Februar 02, 2024

1892

In 2023, the global economic recovery post-epidemic is expected to be sluggish, leading to intensified regional differentiation and disruptions in commodity trade due to geopolitical fragmentation. The semiconductor industry, in particular, bears the brunt of the global economic situation, anticipating a 10% decline in global semiconductor revenue. Nevertheless, amidst these challenges, growth opportunities emerge in specific markets driven by the development of 5G technology and demand from the automotive industry.

On one hand, technological innovations like new energy vehicles, generative AI, the Internet of Things, and big data are playing a pivotal role in revolutionizing supply chain management. These innovations contribute to increased efficiency and transparency, aiding in navigating market uncertainty. However, on the flip side, technological advancements also pose new challenges, particularly in the realms of data security and privacy protection. The heightened volatility in the global political economy further complicates supply chain dynamics, contributing to the anticipated decline in global semiconductor revenue.

Simultaneously, the global distribution and supply chain sector have undergone significant transformations in 2023, responding to technological advancements, market fluctuations, policy changes, and environmental challenges. The semiconductor distribution industry, in particular, has transitioned from persistent shortages to a downturn. This shift is primarily attributed to the substantial impact of geopolitics on the supply chain. However, this downturn has presented new opportunities for distributors. The recovery trend in upstream equipment within the global semiconductor industry signals a gradual revitalization of the sector.

This article aims to assess the status and future trends of the semiconductor distribution industry in 2023 by scrutinizing ten listed companies in this field. By analyzing the characteristics and advantages of these companies, we seek to gain insights into the development trajectory of the semiconductor distribution industry amidst the complex global economic landscape.

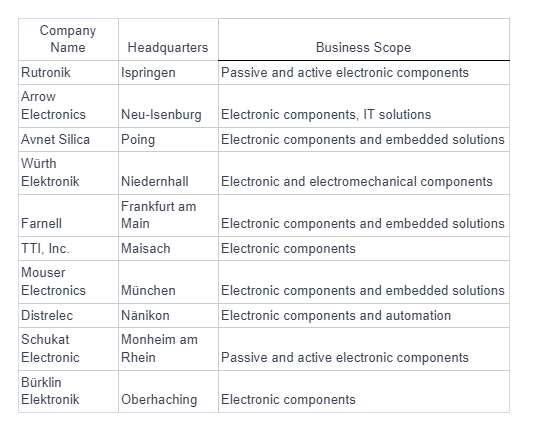

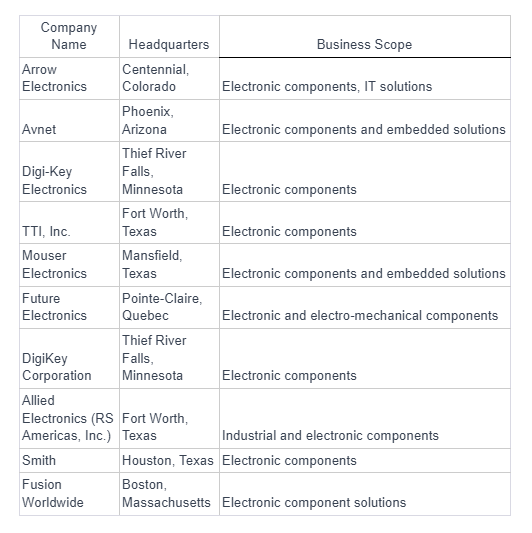

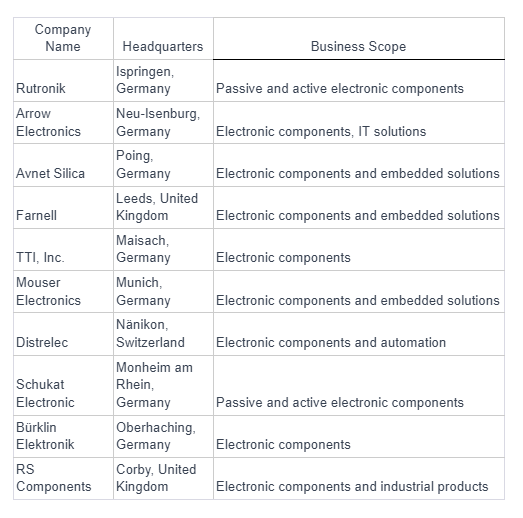

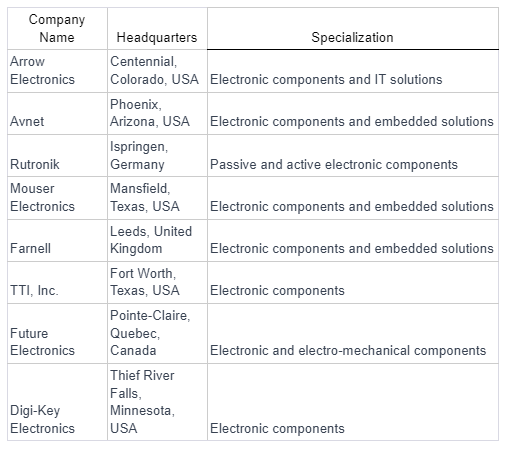

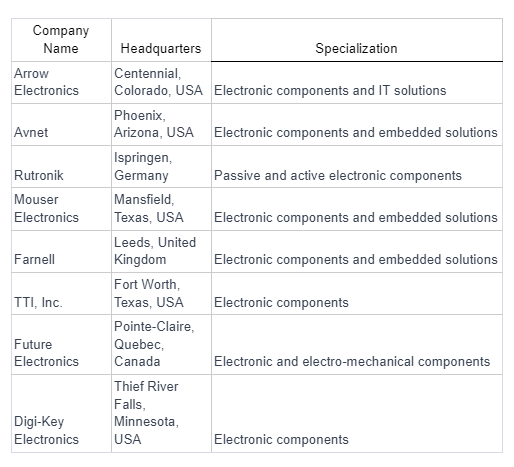

Arrow Electronics, Inc. stands as a global leader in electronic components and enterprise computing solutions. Based in Centennial, Colorado, USA, the company operates in over 90 countries, serving as a pivotal link between technology manufacturers and a diverse customer base. Arrow specializes in providing an extensive range of products, including semiconductors, passive components, and electromechanical components, along with enterprise computing solutions.

Arrow Electronics, headquartered in Centennial, Colorado, is a prominent American Fortune 500 company specializing in the distribution and value-added services of electronic components and computer products. As of 2023, it holds the 109th position in the FORTUNE 500 list, showcasing its status among the largest corporations in the United States by total revenue. Notably, Arrow Electronics has consistently been recognized as one of the "World’s Most Admired Companies" by FORTUNE for ten consecutive years.

WPG Holdings LTD, headquartered in Taipei, Taiwan, is committed to establishing itself as a premier international electronics distributor with a strong focus on the Asia-Pacific market. The company operates through four semiconductor components distributors, namely WPIg, SACg, AITg, and YOSUNg, serving as valued franchise partners for approximately 250 global suppliers. Boasting a workforce of 5,000 across 76 sales offices globally, WPG achieved an impressive revenue of US$25.97 billion in 2022.

WPG is committed to fostering trust through technological advancements and aims to create a co-opetition eco-system through strategic alliances within the industry. The company actively promotes digital transformation based on the principles of customer orientation, technology empowerment, collaborative ecosystem, and era co-creation, aligning with Gartner Research's recognition in March 2023 as a key player in the industry.

Avnet, Inc., a prominent distributor of electronic components, traces its roots back to its founding by Charles Avnet in 1921. Named after its visionary founder, the company had humble beginnings, starting on Manhattan's Radio Row. Initially, it primarily focused on providing electronic components to meet the burgeoning demands of the evolving technology landscape.

Headquartered in Phoenix, Arizona, Avnet operates globally, serving a diverse clientele across various industries. The company's presence spans multiple continents, aligning with its commitment to providing electronic components and solutions on a worldwide scale.

In 1955, Avnet achieved a significant milestone by incorporating as Avnet, Inc., signaling its commitment to long-term growth and strategic development. During this period, the company experienced notable expansion, broadening its product offerings and solidifying its position within the electronic components distribution sector.

A pivotal moment in Avnet's history occurred in 1961 when the company took a major step by becoming a publicly traded entity. Avnet's initial public offering marked a significant chapter, as its shares were listed on the New York Stock Exchange (NYSE). This move not only provided financial impetus but also increased Avnet's visibility in the marketplace.

On May 8, 2018, Avnet underwent a strategic shift by transitioning its stock market listing from the NYSE to Nasdaq. This move, while retaining the familiar ticker symbol AVT, reflected the company's adaptability and responsiveness to evolving market dynamics. The migration to Nasdaq positioned Avnet within a dynamic trading environment known for its tech-centric focus.

Future Electronics Inc., a leading distributor of electronic and electro-mechanical components, has its headquarters situated in Pointe-Claire, Quebec. This strategic location serves as the central hub for the company's extensive operations that span globally. In addition to being a key player on the international stage, Future Electronics is recognized as one of the largest privately-owned companies in Quebec, contributing significantly to the local economy.

With a commitment to excellence and innovation, Future Electronics has achieved the status of being the third-largest electronics distributor worldwide. This global recognition underscores the company's influence in the electronics industry. Operating across 170 locations in 44 countries, Future Electronics has established a far-reaching network that spans the Americas, Europe, Asia, Africa, and Oceania.

In 2014, Future Electronics reported robust revenues amounting to $5 billion. This financial achievement reflects the company's ability to navigate the complexities of the electronic components market successfully. Future Electronics' commitment to sound financial practices and strategic investments has contributed to its sustained growth and market leadership.

Established in 1972 by Ronald Stordahl, DigiKey Corporation, headquartered in Thief River Falls, Minnesota, has evolved into a significant player in the distribution of electronic components. The company's foundation is rooted in the vision of providing a reliable and extensive source for electronic components, catering to the diverse needs of engineers, hobbyists, and professionals.

DigiKey stands out as a privately-owned entity, with Ronald Stordahl retaining ownership. This unique structure allows the company to maintain a steadfast focus on its core values and long-term goals, fostering an environment that encourages innovation and customer-centric practices.

In essence, DigiKey Corporation's journey from its founding by Ronald Stordahl to its current standing as a major player in electronic component distribution is marked by a commitment to innovation, customer satisfaction, and a unique legacy in the amateur radio community.

Smith, a prominent player in the electronics distribution sector, has established itself as a key contributor to the global supply chain. The company's headquarters are situated in Houston, Texas, USA. Since its inception, Smith has evolved into a leading distributor of electronic components, playing a vital role in connecting manufacturers and customers worldwide.

At the core of Smith's services lies its comprehensive product portfolio. The company serves as a go-to source for a wide array of electronic components, including semiconductors, integrated circuits, passive components, and more. Smith's commitment to offering a diverse and high-quality inventory solidifies its standing in the electronics distribution landscape.

Mouser Electronics, Inc. stands as a prominent global distributor specializing in semiconductors and electronic components. The company's significant global presence is reflected in its annual revenue, exceeding $4 billion, positioning Mouser as the seventh-largest electronic component distributor on a global scale.

Operating from 28 locations around the world, Mouser's international footprint enables it to effectively serve a diverse customer base. The company's global workforce, comprised of over 3,900 employees, contributes to its operational efficiency and ability to meet the demands of a dynamic electronics market.

TTI, Inc., a distinguished distributor of electronic components, has been a trailblazer in the industry since its establishment in 1971 by Paul Andrews. Originally named Tex-Tronics, Inc., the company underwent a transformation to become TTI, Inc., in 1973 under Andrews' leadership. TTI, Inc. is renowned for its commitment to serving aerospace and defense equipment manufacturers, a legacy that has expanded to include clients in the transportation, industrial, medical, and communications sectors.

TTI, Inc. and its subsidiaries, collectively known as the TTI Family of Specialists (TTI FOS), include Mouser Electronics, Sager Electronics, and Exponential Technology Group. With a workforce of over 8,000 people across 136 locations worldwide, TTI, Inc. has a substantial global presence, serving customers in the Americas, Europe, Asia, and Africa.

RS Americas, Inc., formerly known as Allied Electronics & Automation, stands as a prominent omni-channel provider of product and service solutions for the design, construction, and maintenance of industrial equipment and operations. As part of the RS Group, plc, a global leader in omnichannel distribution for industrial applications, RS Americas has played a pivotal role in shaping the landscape of industrial solutions.

The roots of RS Americas trace back to 1928 when it was founded in Chicago, Illinois, as Allied Radio by Simon "Sy" Wexler. Operating as the radio parts distribution arm of Columbia Radio Corporation, which Wexler founded in 1921, Allied Radio became an integral part of the burgeoning radio and electronics industry during its formative years.

Fusion Worldwide has emerged as a leading player in the dynamic realm of electronic component solutions, serving as a reliable partner for industries worldwide. With a commitment to innovation and a global footprint, Fusion Worldwide has established itself as a key player in the ever-evolving electronics distribution landscape.

Fusion Worldwide operates on a global scale, with a strategic presence in key locations across North America, Europe, Asia, and other regions. This expansive network enables the company to navigate the complexities of the global electronics market, fostering partnerships and delivering timely solutions to clients worldwide.

The semiconductor distribution industry has been a vital part of the electronics industry over the past few decades. The current status and development trajectory of the industry are affected by multiple factors, including technological advancement, market demand, global economic conditions and geopolitics.

Technological innovation: The semiconductor industry has always been at the forefront of technological innovation, and the continuous emergence of new generation chips has promoted market development.

Market demand: The rapid development of 5G technology, artificial intelligence, the Internet of Things, and new energy vehicles has placed higher demands on the semiconductor industry and also provided growth opportunities for distributors.

Economic Recovery: The semiconductor distribution industry is directly affected by global economic conditions. Economic recovery will help increase corporate and individual spending levels, thereby driving demand for semiconductor products.

Geopolitical Impact: Geopolitical tensions could lead to supply chain disruptions, affecting the stability of global semiconductor distributors.

Supply chain complexity: The global semiconductor supply chain is becoming increasingly complex, and distributors need to manage the supply chain more effectively to cope with global challenges such as raw material shortages, transportation issues, etc.

Vertical integration: Some distributors use vertical integration, including acquiring manufacturers or other links in the supply chain, to increase supply chain transparency and control.

Digital transformation: Many semiconductor distributors use digital transformation to improve business efficiency, including adopting advanced supply chain management systems, IoT technology, and data analytics.

E-commerce platforms: The rise of e-commerce platforms makes it easier for customers to browse, compare and purchase semiconductor products, and also provides distributors with broader market coverage.

Market competition: The semiconductor distribution market is highly competitive. There are many large distributors and some professional regional distributors around the world.

Market structure: Some large distributors expand their market share through acquisitions and mergers, forming the market structure of the industry.

The semiconductor distribution industry continues to evolve, driven by technological changes and market demands. As digital transformation advances, supply chain complexity increases, and industry players need to flexibly adapt to changes while paying attention to global economic and geopolitical dynamics to ensure sustainable business development.

What is an electronic component distributor?

Electronic component distributors serve as vital intermediaries in the electronics supply chain, procuring a diverse range of components directly from manufacturers and maintaining extensive inventories. These distributors play a crucial role in logistics, ensuring timely delivery to original equipment manufacturers (OEMs) and other businesses. With a global reach, they offer supply chain support, value-added services, and market intelligence, simplifying the procurement process for companies. Additionally, distributors help mitigate supply chain risks by managing inventory and providing alternative sourcing options. Overall, they facilitate the seamless flow of electronic components, contributing to the efficiency and accessibility of the electronics industry.

Which industries use electronic components?

Electronic components play a pivotal role across diverse industries, including automotive, communication, computing applications, industrial, and others. In the automotive sector, components are essential for functions like engine control and safety systems, while the communication industry relies on them for smartphones, routers, and networking equipment. Computing devices, such as computers and servers, benefit from electronic components for processing power and memory. The industrial sector utilizes these components in automation, control systems, and robotics. Beyond these, electronic components find applications in various other industries, showcasing their integral role in powering technologies across the modern landscape and contributing to advancements in healthcare, aerospace, defense, and energy.

What are the most used electronic components?

Resistors, capacitors, inductors, diodes, LEDs, transistors, crystals, oscillators, electromechanical components like relays and switches, integrated circuits (ICs), and connectors stand as the cornerstone electronic components extensively utilized in electronic circuitry. These components collectively enable the construction of diverse electronic devices, providing functionalities such as current control, energy storage, signal modulation, amplification, and precise timing.

How big is the electronic component market?

As of 2022, the global electronic components market is estimated to be valued at approximately USD 190.28 billion. Projections indicate significant growth, with expectations that the market will reach around USD 368.4 billion by the year 2032. This anticipated expansion reflects a compound annual growth rate (CAGR) of 6.83% during the forecast period from 2023 to 2032.

Where are most electronic components made?

Most electronic components are manufactured in China, which has become a global hub for electronics production. China, along with Hong Kong, is a leader in the manufacturing of electronic components and devices. The country's well-established infrastructure, skilled workforce, and efficient production capabilities have contributed to its dominant position in the electronics industry.

The United States also plays a significant role in electronics production, particularly in the development of advanced technologies and semiconductor manufacturing. However, a considerable portion of electronics manufacturing has shifted to China due to cost-effectiveness and the availability of resources.

Website: https://www.censtry.com/