Veröffentlicht :24.07.2023 08:19:16

Klicken Sie auf Zählen:2103

Recently, TSMC announced its financial report for the second quarter of 2023. Both operating income and net profit have declined, and it has lowered its performance expectations for the next quarter. At the same time, due to the lack of skilled workers, its factory in Arizona, USA, will postpone the start of production from 2024 to 2025.

Both revenue and profit decline, and US factory construction plans are delayed

According to the report, TSMC’s operating income in the second quarter was approximately NT$480.84 billion, a decrease of 10.0% from the same period last year and a decrease of 5.5% from the previous quarter; net profit was NT$181.8 billion, a decrease of 23.3% from the same period last year and a decrease of 12.2% from the previous quarter. In US dollars, TSMC's revenue in the second quarter of 2023 will be 15.68 billion yuan, a decrease of 13.7% from the same period last year and a decrease of 6.2% from the previous quarter.

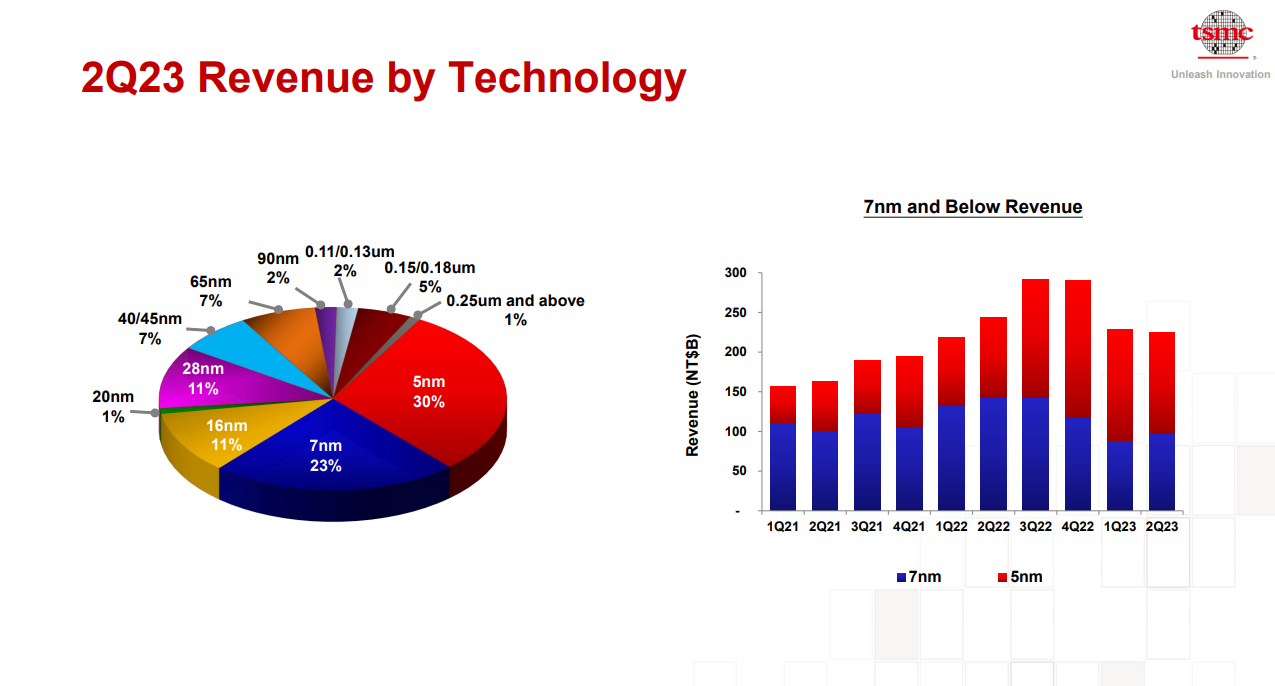

In terms of process classification, TSMC’s 5nm process shipments accounted for 30% of the wafer sales in the second quarter, 7nm process shipments accounted for 23% of the full-quarter wafer sales, and 16nm and 28nm process shipments accounted for 11%. Overall, revenue from advanced processes (including 7nm and more advanced processes) in the second quarter accounted for 53% of the total wafer sales in the quarter.

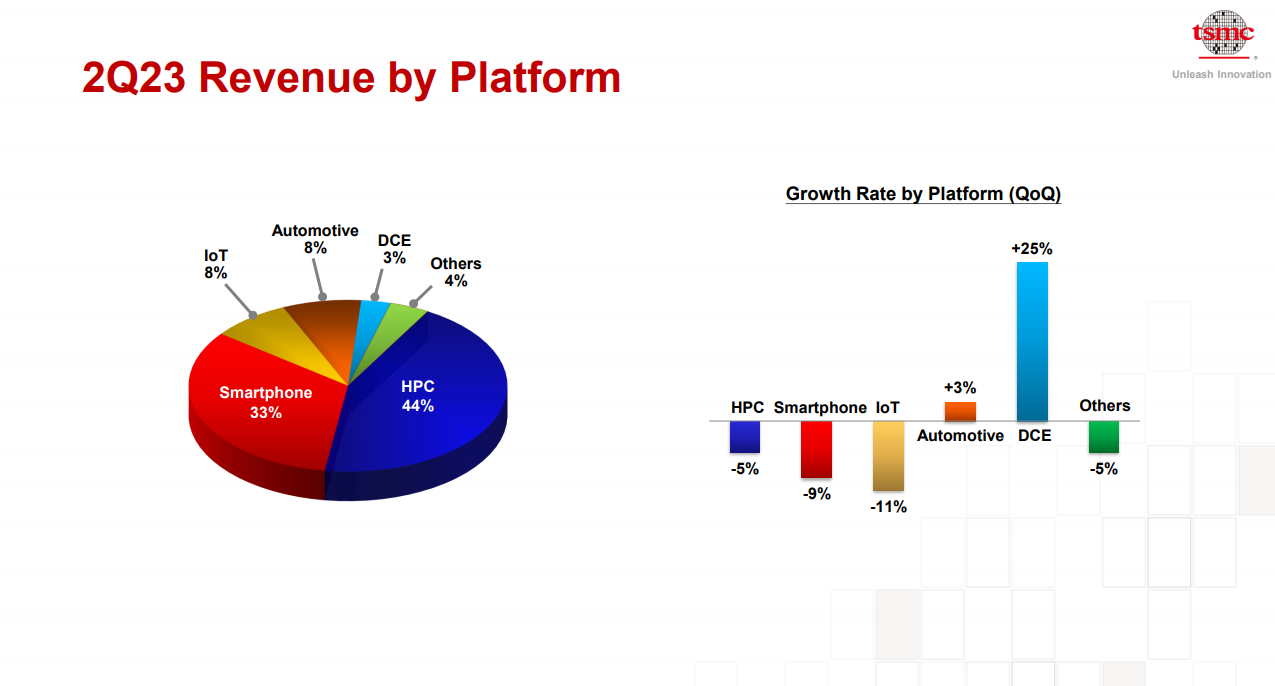

In terms of technology platform classification, TSMC’s high-performance computing operating revenue accounted for a relatively high proportion in the second quarter, reaching 44%, followed by smartphones, accounting for 33% of operating income, Internet of Things, automotive electronics, and consumer electronics revenue accounted for 8%, 8%, and 3%. In contrast, consumer electronics revenue surged 25% from the previous quarter, and automotive revenue rose slightly by 3%.

Regarding the reason for the decline in performance, TSMC stated that due to the continued weakening of the overall economic situation and the weak overall demand in the terminal market, the recovery of market demand has been slower than expected, and customers are more cautious, and intend to further control inventory.

TSMC expects the company’s sales in the third quarter to be US$16.7 billion to US$17.5 billion, a quarter-on-quarter increase of 6.5%-11.6%, with an average increase of about 9.1%, which is about 10% lower than market expectations. The gross profit margin in the third quarter is estimated to be 51.5%-53.5%, lower than the 54.1% in the second quarter; the operating profit margin is estimated to be 38%-40%, lower than the 42% in the second quarter.

TSMC is also more cautious in capital expenditure this year. Huang Renzhao said that in response to short-term uncertainties, TSMC has moderately tightened its capital expenditure plan. This year's capital expenditure will range from 32 billion to 36 billion US dollars. It is understood that in TSMC's capital expenditure in 2023, advanced process technology will account for 70% to 80% of the total, mature special technology will account for 10% to 20%, and the rest will be allocated to advanced packaging, testing and other projects.

Regarding the progress of the 3nm and 2nm processes, TSMC chairman Wei Zhejia said that driven by high-performance computing (HPC) and smartphone applications, the 3nm process is expected to grow rapidly in the second half of the year, and will contribute a mid-single-digit percentage (4% to 6%) this year. As for the upgraded 3nm process (N3E), Wei Zhejia revealed that it has passed the verification and reached the performance and yield targets. It is expected to be mass-produced in the fourth quarter of this year.

At the same time, the research and development of 2nm process technology is progressing smoothly, and it will be mass-produced in 2025 as scheduled, using a nanosheet transistor structure. He said that TSMC 2nm has also developed a backside rail solution, which is suitable for high-performance computing-related applications. The target is to launch it in the second half of 2025 and mass-produce it in 2026.

In terms of overseas capacity expansion, Liu Deyin, chairman of TSMC, introduced that the factory in Arizona, USA is now entering a critical stage of processing and installing the most advanced and special equipment. However, there are challenges due to the insufficient number of skilled workers with the equipment installation expertise required in semiconductor-grade facilities.

TSMC announced in May 2020 that it would build a plant in Arizona, with an initial commitment of US$12 billion. In December last year, TSMC announced that it would increase its investment to US$40 billion. It was originally expected to start production in 2024.

TSMC stated that it is working hard to improve the situation by dispatching experienced technicians from Taiwan, China to train local skilled workers for a short period of time. It is expected that the production plan of N4 process technology will be postponed to 2025.

In addition to the U.S. factory, Liu Deyin pointed out that TSMC is building a fab with special process technology in Japan, using 12/16nm and 22/28nm processes, and the company is expected to mass produce by the end of 2024 as scheduled. In Europe, he revealed that he is in contact with customers and partners to evaluate the possibility of establishing a special process fab in Germany focusing on automotive technology based on customer needs and government support levels.

Inventory adjustment is weaker than expected, and strong AI demand has a positive impact

The industry has been looking forward to the news that the semiconductor market is picking up. TSMC President Wei Zhejia said bluntly that the current semiconductor inventory adjustment is continuing as expected by the market, and the general trend is weaker than previously expected. The terminal demand in the market continues to be poor. Although AI is strong, it still cannot fully make up for the lack of demand. When the inventory is adjusted, everything depends on economic factors.

Although TSMC's revenue and profit both declined in the second quarter, the strong demand for AI contributed significantly to the company. Wei Zhejia said that generative AI requires higher computing power and interconnect bandwidth, which promotes the increase in semiconductor content.

In his view, whether using CPUs, GPUs, or AI accelerators, as well as related special application chip ASICs for AI and machine learning, the common denominator is the need to use advanced technology and a strong wafer manufacturing design ecosystem. These are TSMC's advantages.

The industry believes that the decline in TSMC's performance in the second quarter was less than expected, which is mainly beneficial to artificial intelligence. According to the above introduction, TSMC’s high-performance computing operating income in the second quarter reached 44%, including GPU foundry, and its business fell by 5% from the previous quarter, which was a significant improvement from the previous quarter’s decline of 14%.

And this will continue to contribute to TSMC's performance in the future. At present, the training of large models at home and abroad uses Nvidia's GPU, and TSMC is the manufacturer of Nvidia's GPU. In addition, AMD recently launched MI300, which competes with Nvidia H100. It is reported that this product will also be manufactured by TSMC, and AMD CEO Lisa Su told the media recently that AMD will continue to cooperate with TSMC to develop next-generation products.

According to Wei Zhejia, the demand for server AI processors such as CPUs, GPUs and AI accelerators that perform training and reasoning functions accounts for about 6% of TSMC's total revenue. It is expected that this demand will increase at a compound annual growth rate of nearly 50% in the next five years, and the proportion of TSMC's revenue will also increase to the low ten-digit percentage range.

Summary

Judging from TSMC's performance, the semiconductor market is still in a downward trend. As TSMC said, the general trend of inventory adjustment is weaker than expected. TSMC has also been more cautious in capital spending, and the progress of its U.S. factory has also been delayed. However, we can also see some positive signs. For example, consumer electronics has increased significantly compared with the previous quarter, and the demand for automotive electronics is also growing. In addition, the strong demand for AI has driven the growth of semiconductor market demand to a certain extent, and may continue to have a positive impact on the semiconductor market in the future.