September 02, 2021

1855

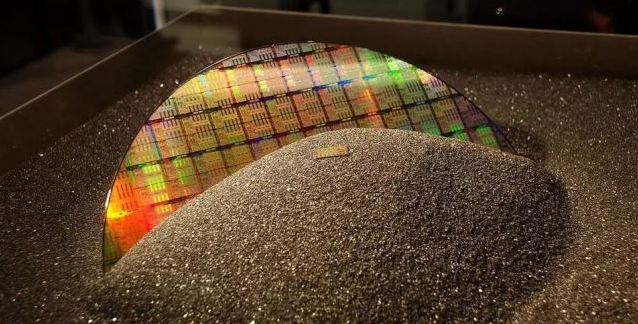

A few days ago, TSMC suddenly issued a letter informing that it would directly increase prices on the same day. Advanced processes such as 5nm and 7nm will increase by 10%, and mature processes will increase by 20%.

Since the price increase came suddenly and eagerly, everyone didn't react for a while. When it came to life, the chain reaction caused by TSMC's price increase began to appear.

Peers are more confident

Revenue data in July showed that the revenue of wafer foundries such as UMC and the world advanced hit a new high, but TSMC dropped 16.1% from June. It was the only wafer foundry in Taiwan that did not increase but decreased. It also strengthened TSMC's determination to raise prices.

The rise of TSMC has also given its peers more confidence.

After the news of TSMC's price increase, UMC, which originally planned to increase the foundry price in the fourth quarter, also notified customers that it will raise the foundry price again since November, with an average increase of more than 10%. Among them, driver chips rose by 10% to 15%, and special high-voltage processes rose by more than 10%.

In addition, according to Korean media reports, the two foundries of Samsung Electronics and Key Foundry also plan to increase the rate by 15% to 20%, and have informed their customers of the matter, and have signed contracts with some customers.

The adjustment range of the quotation will be determined according to the size of the customer's order, the type of chip and the length of the foundry contract. The applicable period for price increases is four to five months from now, and new quotations are also used for products that have already been ordered. South Korean packaging and testing and assembly plants also intend to increase prices in September.

IC design houses, EMS manufacturers shout up

Wafer foundries have raised prices one after another, and chip manufacturers and foundry companies must also reflect the increase in costs, and many companies have already decided to raise them.

Regarding TSMC’s price increase, the electronics foundry Compal said at the shareholder meeting that it will adjust prices to customers to reflect the increase in costs. Quanta said that components, freight, and exchange rates have risen three times. At the beginning of this year, it was reported that computer foundries were planning to increase foundry costs this year. Quanta also confirmed that it plans to report costs to customers and fired the first shot of price increases.

As for IC design manufacturers, Wei Chuan Electronics has decided to increase its product quotations by 15% since October because they are mainly engaged in production at Taiwan Semiconductor Manufacturing Co., Ltd. to reflect costs to customers. The previous wave of price increase of Wei Quan Power was in April, when the increase was 10% to 20%, mainly because of the substantial increase in packaging and testing costs.

After MCU manufacturer Holtek announced a price increase in the second quarter, its quotations have risen again since August. Songhan has raised prices this year, and a new wave of price adjustments has been brewing recently.

Mobile phone and server players have a big impact

TSMC’s 20% price increase will have a direct impact on mobile phones, automobiles, and servers. The degree of impact depends on the internal semiconductor content of these products.

Forbes wrote and analyzed that taking the iPhone 12 as an example, the material cost is estimated to be US$370, and the chip is about US$210 in addition to the screen, battery and mechanical components. Therefore, semiconductors account for a quarter of this $829 mobile phone. If the price of the chip increases by 15%, the cost will increase by approximately US$30. Apple is likely to need to increase the price of mobile phones in order to maintain the original profit margin.

Servers are basically metal plates wrapped around a pile of chips and some hard drives. There are usually two CPUs in it, with a total cost of US$2,100, plus memory and other components. A server that sells for US$7,500 contains about US$4,800 worth of semiconductors. In other words, the chip accounts for about US$4,800 in the server. Two-thirds of the price. If you use a solid state drive, it is more expensive. Even if the price of the chip only rises by 10%, it will increase the selling price by 7%-8%.

In the cost of automobile manufacturing, chips account for a relatively small proportion, and the impact is not so great.

Wide impact

Since the beginning of this year, due to the huge increase in foundry costs, coupled with high freight rates and various raw material costs, the prices of driver chips, power management chips, Netcom chips, audio chips, and microcontrollers (MCU) have all followed suit. The rise has become the main reason for the increase in the cost of the electronics industry this year.

In the latest global ranking of foundries, TSMC ranks first with 52.9% of the market share, and TSMC’s 20% price increase has a broader impact on the industry chain.

From IC design customers to PCs, mobile phones, TVs, automobiles, home appliances and other various terminal industries, next year will inevitably face a new wave of rising costs.